100 Percent Disabled Veteran Benefits New York

benefits veteran yorkNew York Veteran Recreation Benefits Hunting Licenses Permits for Disabled Veterans NY resident veterans with a 40 or greater disability rating can get low cost hunting and fishing licenses. No cost health care and prescription medications.

VA Disability Compensation Pay.

100 percent disabled veteran benefits new york. See all New Mexico Veterans Benefits. New York State Department of Motor Vehicles allows veterans to. There are a variety of discounts and perks for veterans from the State.

Depending on what city or town you live in New Hampshire offers qualified Veterans a tax credit for up to 750 annually and if you are a 100 permanently and totally disabled Veteran as determined by the Veterans Benefit Administration you will be eligible for up to 4000 in property tax relief. Routine dental treatment for teeth or jaws is provided to Veterans who are 100 percent ser- vice-connected have a service-connected dental disability or are former prisoners of war. VA outlines TDIU regulations under 38 CFR 416 which encompasses subsections a and b.

Under chapter 35 Must be rated a 100 disabled veteran by the VA. Each subsection sets forth the standard by which veterans may meet the requirements for TDIU. In 2020 a 100 percent VA disability rating is worth a minimum of 310604 per month and is tax free at both the state and federal levels.

According to VBA data reported to congress 12 of disabled veterans or 684851 out of. New York State Recreation Benefits For Veterans. The New York State Thruway Authority offers free unlimited travel anywhere on the Thruway to certain qualifying disabled Veterans.

If youre a Veteran with a 70 disability rating and you have a spouse plus 3 dependent children under the age of 18 you would start with the basic rate of 165671 for a Veteran with a spouse and 1 child. Dental treatment for 100 disabled veteran benefits. Top 20 VA Benefits for 100 Percent Disabled Veterans Explained NEW 100 Percent VA Disability Pay Rate.

An 100 percent disabled veteran will receive a full property tax exemption. If you would like to learn more about the benefits and services you may be eligible for as a Veteran servicemember or as a family member of a Veteran or servicemember please call the New York State Division of Veterans Services Help Line at 18888387697 VETSNYS where you may also schedule an appointment with one of our Veterans. Must be rated a 100 disabled veteran by the VA.

Educational Assistance for Dependents. Travel allowance for scheduled appointments for care at a VA. Any New Mexico state resident veteran with a 100 VA disability rating may be eligible to apply for a complete waiver of all property taxes on a primary residence.

Military benefits are always changing. Veterans Benefits Banking Program VBBP 4. Civilian health and medical program for dependentssurvivors CHAMPVA.

A disabled veteran in New Jersey may receive a full property tax exemption on hisher primary residence if the veteran is 100 percent disabled as a result of wartime service. Again TDIU pays the same monthly compensation rate as a 100 VA disability rating which as of December 2020 was 314642. VA Special Monthly Compensation Benefits.

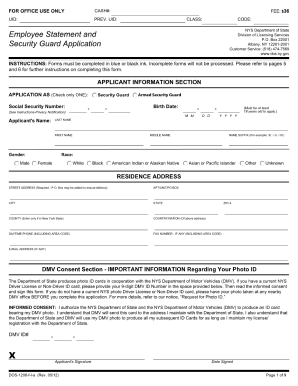

Complete List of Top 25 Disabled Veteran Benefits. The Thruway Authoritys only qualifying criteria for the Disabled Veterans E-ZPass Non-Revenue program is a fee-exempt vehicle registration from Department of Motor Vehicles DMV. Additional New York Veteran Benefits New York State Motor Vehicle Registration Fee Exemption.

Stay on Top of Your Veteran Benefits. New York veterans may be eligible for one of three property tax exemptions for a veteran-owned primary residence. New York Property Tax Exemptions.

For active duty and retired members of the Uniformed Services their families and survi-.