Where To Mail Va Amended Return

amended mail wallpaperRichmond Virginia 23218-1498. Virginia Department of Taxation.

Https Www Tax Virginia Gov Sites Default Files Vatax Pdf 2019 500 Instructions Pdf

There is no street address.

Where to mail va amended return. Virginia Department of Taxation PO. West Virginia State Tax Department. Virginia Department of Taxation.

10 Rules for Filing an Amended Tax Return. Starting Tax Year 2019 the 1040X is efileable see KB 804 If you are filing Form 1040X in response to a notice you received from the IRS mail it to the address shown on that notice. Filing a State Return.

Please submit a paper amended tax return. West Virginia State Tax Department. Box 942867 Sacramento CA 94267-0001.

To find a proper mailing address go to irsgovfile. The drawback of filing an amended return is that the document has to be mailed to the IRS Service Center that processed the original tax form and can take up to 16 weeks to be processed. Below I copied and pasted the instructions for a US Federal amended return from the 1040X instructions.

Mail the Form 1040-X to the address listed in the forms instructions PDF. To mark Form 502 as an amended return from the main menu of the Virginia return select Heading Information Amended Return. Box 1498 Richmond VA 23218-1498 Tax Due Returns.

Filing an amended tax return with the IRS is a straightforward process. Use Form 1040-X Amended US. As of the 18 th of April the IRS had received more than 131 million returns of which 88 percent were e-filed.

Please refer to the following mailing addresses below if you have a specific tax. To file the amended state return for a prior year you must mail a paper return unless you are using the Professional program. Mail your federal return to the Internal Revenue Service Center listed for the state that you live in.

Virginia Employment Commission PO Box 1358 Richmond Virginia 23218-1358 Equal Opportunity EmployerProgram. Individual Income Tax Return with the IRS Wheres My Amended Return tool. Detailed instructions are available on our website WWWVAEMPLOYCOM under Employer Services.

This article includes step-by-step instructions for when and how to amend your tax return using Form 1040-X. You can send your 2017 Virginia income tax return directly to the Richmond office or to the city or county where you lived on January 1 2018. Reasons You Need to File an Amended Virginia Income Tax Return Changes to Your Federal Return.

Virginia Department of Taxation. The Maryland amended return should have the address on it near the signature section. Otherwise mail your 1040X to the address listed below.

If you are not including a payment andor are expecting a California tax refund mail it to Franchise Tax Board PO. To amend an EIP return see Related Links below. Box 942840 Sacramento CA 94240-0001.

Richmond Virginia 23218-0760. Charleston West Virginia 25336-3694. With the 1040X I included a memo describing how I arrived at my refund amount.

The agency projects that almost five million taxpayers however will need to file an amended return during 2014. No for the Federal return you do not have to attach a copy of the original return unless instructed to do so. Type information print sign and mail completed form.

After my CRSC was approved I filed an amended tax return for 2012. Amending both a state and federal return. To mail your return directly to us use the correct mailing address below depending on whether you expect a refund or owe taxes.

The zip code indicated in the chart below is exclusive to the corresponding IRS processing center. If youre including a payment with your amended return mail it to Franchise Tax Board PO. EIP returns cannot be amended on paper or through e-file using From 1040-X.

Many taxpayers find the easiest way to figure the entries for Form 1040-X is to make the changes in the margin of the original tax return and then transfer the numbers to their Form 1040-X. Of the Navy letter approving my CRSC and a copy of the Strickland letter. Taxpayers cant file amended returns electronically.

VEC FC-34 - Combined Amended Quarterly Tax and Wage Reports This form is web-enabled. COVID-19 Mail Processing Delays Its taking us longer to process mailed documents including. Mark the check box Amended Return sign the form and mail it to one of the addresses listed below.

I also included copies of my VA Rating Decision Dept. Individual Income Tax Return to correct errors to an original tax return the taxpayer has already filed. For details see httpstaxvirginiagovwhere-to-file Refund Returns.

Box 1498 Richmond VA 23218-1498. Check the status of your Form 1040X Amended US. Where do I mail my amended return Form 1040X.

You can not eFile a VA Tax Amendment anywhere except mail it in. If you dont owe taxes but also arent getting a refund use the Refund Returns address. You can file an amended tax return to make the correction.

If you or the IRS changes your federal return youre required to fix or correct amend your Virginia return to reflect the changes on your federal return within one year of the final determination date of the federal change. The preference is to the local office. Did you make a mistake on your tax return or realize you missed out on a valuable tax deduction or credit.

Virginia Department of Taxation PO. Virginia only accepts for e-file an amended Form 502 for the current year and two prior years. Amended returns that cannot be e-filed should be mailed.

Fiduciary and Estate - Fiduciaries must complete an amended Form 770. State amended returns vary.

Https Www Fairfaxcounty Gov Taxes Sites Taxes Files Assets Documents Pdf Business 2020 Bpp Brochure Pdf

Stumped How To Form A West Virginia Llc The Easy Way

Prepare And Efile Your 2020 2021 Virginia Income Tax Return

Https Www Tax Virginia Gov Sites Default Files Inline Files Va8879 2019 Pdf

Https Www Lenderhomepage Com Online Form Files 101568 Va 20disclosures Pdf

Https Www Tax Virginia Gov Sites Default Files Inline Files Retail Sales And Use Refund Procedures Guidelines June 2017 Pdf

Https Www Tax Virginia Gov Sites Default Files Vatax Pdf 2020 Form 765 Instructions Pdf

Https Www Tax Virginia Gov Sites Default Files 2016 12 770 2016 Instructions Pdf

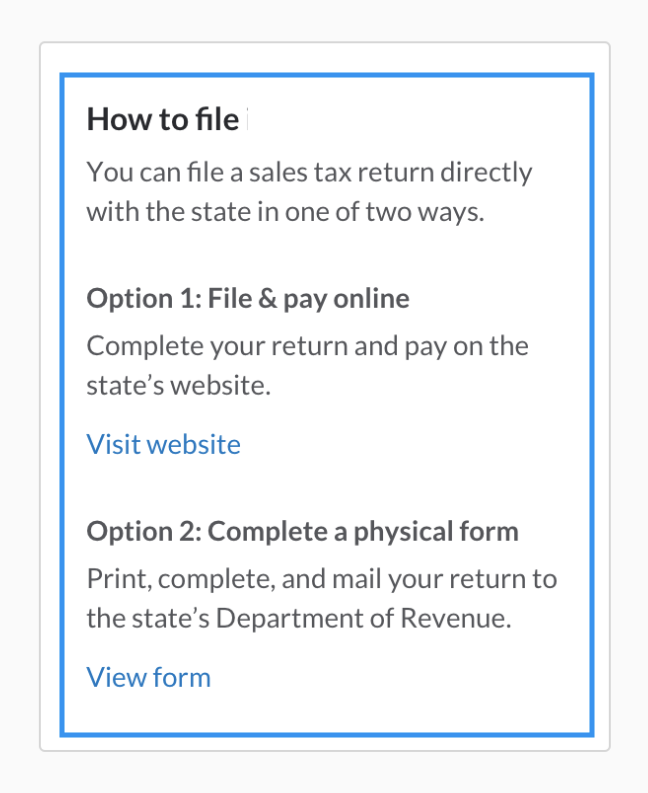

How To File A Virginia Sales Tax Returntaxjar Blog

Https Www Tax Virginia Gov Sites Default Files Taxforms Early Release 2020 Individual Income Tax Draft 2020 760 Instructions Pdf

1098 T Tax Information W 9s Form Bursar S Office Virginia Tech

Real Estate Tax Frequently Asked Questions Tax Administration

Instructions On How To Prepare Your Virginia Tax Return Amendment

Https Www Tax Virginia Gov Sites Default Files Vatax Pdf 2019 763 Instructions Pdf

Https Www Tax Virginia Gov Sites Default Files Vatax Pdf 2019 765 Instructions Pdf

Virginia State Tax Information Support