Military Disability Retirement Pay Taxes

disability military retirement taxesMilitary retirement pay is taxed as ordinary income just like any other pension. Individual Income Tax Return to correct a previously filed Form 1040 1040A or 1040EZ.

List Military Retirement Income Tax

Military retirees ages 55 - 64 can exclude up to 20000 in any one tax year from their retirement pay those 65 and.

Military disability retirement pay taxes. In the eyes of the federal government military retired pay is no different from any other form of income which means that you have to pay income tax on it. You should consider your situation based on your state of residence. Qualified military retirees are those with 20 or more years of service who have a service-connected disability of 50 or more.

X times Active Duty pay at the time of retirement. Military retirement pay based on age or length of service is considered taxable income for Federal income taxes and most state income taxes. VA disability compensation on the other hand is tax free.

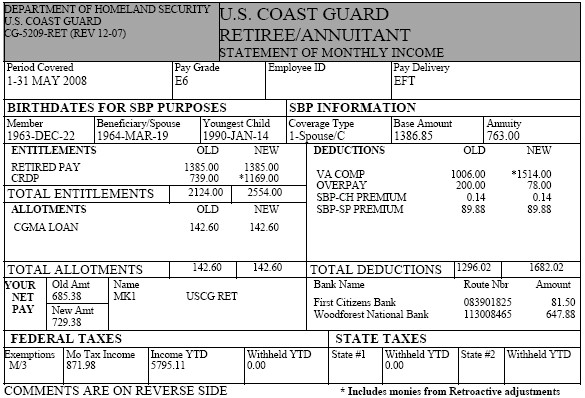

The VA disability compensation is automatically added to your regular. However military disability retirement pay and. Equals Initial amount of tax-exempt gross pay Step 2.

If you are rated less than 50 disabled your military retirement pay is reduced by one dollar for every dollar you. Up to 2000 of military retirement excluded for individuals under age. And there is the rub.

Military retirement pay is considered taxable income by the IRS unless you retired because of a disability. Most military retirement pay is treated and taxed as normal income but in certain cases it can be excluded. Initial amount of tax-exempt gross pay.

For Social Security tax purposes military retirement pay is not considered earned income and no Social Security payroll taxes also known as Federal Insurance Contributions Act FICA taxes are. There are 23 states that either dont have an income tax or dont tax military retirement pay and over 20 that offer special considerations on pensions or military retirement income. Also like civilians the amount withheld depends on what you earn and the number of dependent exemptions you claimed on your Form W-4.

If you entered active or reserve military service before September 8 1980 your retired pay will be based on your final basic pay. To do so the disabled veteran will need to file the amended return Form 1040X Amended US. A tax-exempt amount of gross pay determined by the following formula.

In our example lets say it took three. Like civilians federal tax is withheld from each check or direct deposit. Years of Service x 25 x Retired Base Pay Disability Retired Pay-OR-Disability - not to exceed 75 x Retired base pay Disability Retired Pay.

If you entered active or reserve military service after September 7 1980 your retired pay base is the average of the highest 36 months of basic pay. States With Special Military Retirement Pay Exemptions The first 3500 of military retirement pay is exempt. Since 2004 however their military retirement pay has been reduced to 2000 per month taxable and they receive the 500 disability payment from the VA.

X times applicable Cost-Of-Living-Adjustment COLA. This is because many states tax military retirement pay differently. The combat-disabled veteran applying for and being granted Combat-Related Special Compensation after an award for Concurrent Retirement and Disability.

Taxation of Military Retirement and VA Disability Benefits. Generally payment you receive as a member of the military is taxed as wages. Military not VA disability percentage.

Transition Leave Overview Military Com

7 Sources Of Tax Free Retirement Income Newretirement In 2020 Retirement Income Military Retirement Pay Couples Doing

All Veteran Property Tax Exemptions By State And Disability Rating Military Benefits Veteran Property Tax

Can You Receive Va Disability And Military Retirement Pay Cck Law

Va Disability Compensation Affects Military Retirement Pay

Tax Tips For Veterans And Military Personnel

Federal Taxes On Veterans Disability Or Military Retirement Pensions The Official Army Benefits Website

Disability Compensation Pensions Virginia Department Of Veterans Services

Pin On Https Veteranappeal Com

List Of Benefits Due To Service Connected Disability Veterans Resources Disabled Veterans Benefits Va Disability Benefits Disability Benefit

Is Military Retirement Income Taxable In North Carolina

States That Don T Tax Military Retirement Pay Rapidtax Military Retirement Pay Military Retirement Retirement

How Does Va Disability Pay Affect Social Security Payments The Answer Depends Greatly On Va Disability Disability Benefit Social Security Disability Benefits

Pay And Personnel Center Ppc Retiree And Annuitant Services Directory Assistance

8 Of The Best States For Military Retirees 2021 Edition Ahrn Com

Military Medical Retirement Pay Chart 2020 Va Disability Medical Retirement Va Benefits