Does Retired Military Pay State Taxes In North Carolina

carolina does taxesIf you are serving in the United States Armed Forces and your domicile legal residence is North Carolina you must pay North Carolina income tax and North Carolina income tax should be withheld from your military pay regardless of where you are stationed. In this case vested in the retirement system meant employees had five years of service prior to August 12 1989.

Kentucky All military retirement pay is exempt from state income tax for those who retired prior to 1997.

Does retired military pay state taxes in north carolina. All other retirees qualified for the 4000 or 8000 exclusion until 2013 when the provision was eliminated. You are partially correct. To claim the exemption follow these steps in the program.

North Carolina may not tax certain retirement benefits received by retirees or by beneficiaries of retirees of the State of North Carolina and its local governments or by United States government retirees including military. Instead you receive a partial exemption and only if certain conditions are met. North Carolina exempts all Social Security retirement benefits from income taxes.

North Carolina Retired Military Pay Income Taxes. Resident North Carolina return. State of North Carolina North Carolina may not tax certain retirement benefits received by retirees or by beneficiaries of retirees of the State of North Carolina and its local governments or by the United States government retirees including military.

For those who retired after 1997 military retirement pay is subject to state tax when the pay exceeds 31110. However these exemptions are not full exemptions. Military retirees under the age of 65 can claim state tax exemptions of up to 14600 of military retirement income for 2019.

State of North Carolina that North Carolina could not tax retirement benefits for federal state and local government employees including military who were vested in the retirement system as of August 12 1989. Enter the amount of taxable retirement benefits that qualify for the Bailey Settlement from your federal return. Social Security income in North Carolina is not taxed However withdrawals from retirement accounts are fully taxed Additionally pension incomes are fully taxed.

Military benefits are not taxed in the State of North Carolina if the retiree had five or more years of creditable service as of August 121989. As a result of the North Carolina Supreme Courts decision in Bailey v. Other taxes seniors and retirees in North Carolina may have to pay include the states sales and property taxes both of which are moderate.

The exclusion applies to retirement benefits received from certain defined benefit plans such as the North Carolina Teachers and State Employees Retirement System. This type of military retirement pay is not subject to state or federal. North Carolina is a state which allows certain deductions for retirement income.

You should understand these rules prior to reaching your retirement age. The bill would provide a 50 exemption on military pensions and income received as survivor benefits for military service. That will increase to 75 in 2021 and 100.

North Carolina Filing Instructions. Taxpayers must have other earned income to claim the exemption. One exception to the tax on non-vested military retirement pay over 4000 is Veterans Affairs disability retirement pay.

Other forms of retirement income are taxed at the North Carolina flat income tax rate of 525. If you have a state tax option and your state taxing authority has an agreement with DoD you can use myPay to change your SITW. Up to 5000 of military income is tax-free.

Retirees with at least 5 years creditable service as of August 12 1989 are exempt from state income tax on their military retirement pay due to the Bailey Decision. If they have no other earned income they can claim a deduction of up to 3000. Because tax obligations vary from state to state contact your states department of revenue regarding taxability of your military retired pay By law SITW requests are voluntary and revocable at any time.

If an individual had five years of creditable service as of August 12 1989 all military retired pay is exempt from taxes. Legislation to partially exempt retired military service pension from Montanas state income tax was swiftly introduced in that states 2021 House session. Exemptions in South Carolina.

When it does come to the tax side of things if youre considering a move to North Carolina for retirement its important to keep the following in mind. What if I am retired military. Up to 6250 plus 50 of retired pay over that amount is tax-free for 2019.

For more information see. Honorably discharged North Carolina veterans who are 100 permanently and totally disabled by the VA are eligible for up to a 45000 deduction in the assessed value of their home for property tax. That amount will increase to 17500 in 2020.

Currently in South Carolina military retirees under 65 may deduct up to 14600 off their income taxes. Domicile or legal residence is an individuals permanent home. John Fuller introduced HB.

Individuals over 65 may deduct up to 27000. Maryland Military retirees dont pay state income taxes on the first 5000 of their retirement income. If you qualify under Bailey Turbo Tax will ask you about the Bailey Law for North Carolina in the Federal Taxes section when entering your retirement income.

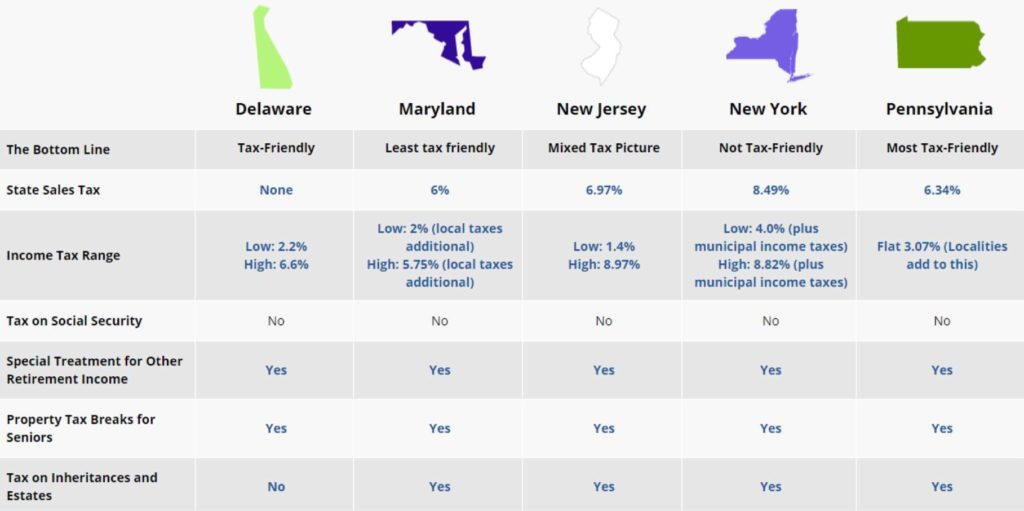

Evaluating Where To Retire Pennsylvania Vs Surrounding States Rodgers Associates

State Income Tax Collections Per Capita 2010 Tax Rate Income Tax Payroll Taxes

Is Military Retirement Income Taxable In North Carolina

Holiday Badge For The American Veteran Owned Business Association Veteran Owned Business American Veterans Veteran

Temporary Lodging Expense Tle For Pcs Moves Katehorrell Military Lodging Lodges Navy Lodge

Best Places To Retire In North Carolina Best Places To Retire North Carolina Lakes Retirement Locations

Colorado Retirement Tax Friendliness Smartasset

8 Of The Best States For Military Retirees 2021 Edition Ahrn Com

States With The Highest And Lowest Property Taxes Homes Com Property Tax States State Tax

Free North Carolina Power Of Attorney Forms Pdf Templates Power Of Attorney Power Of Attorney Form Attorneys

Texas State And Local Veteran S Benefits Including Education Employment Healthcare Home Loans Tax Exemptions Recreation A Veterans Benefits Veteran Texas

Property Taxes By State Property Tax Estate Tax Tax Payment

States That Don T Tax Military Retirement Pay Military Benefits Military Retirement Military Retirement Pay Military Benefits

Find Connecticut State And Local Veteran S Benefits Including Education Employment Healthcare Tax Breaks Exempti Military Benefits Veterans Benefits Veteran

Asknc Why Does North Carolina Tax The Pensions Of Some Military Retirees Nc Center For Public Policy Research

Property Tax Revenue As A Percentage Of All State Local Revenue Tax Rate Income Tax Payroll Taxes