Greece Imf Bailout History

bailout greece historyIt has a quota of 242890 million SDRs and 25754 votes 051 of the total IMF quota and votes. It told creditors to take further write-downs on the more than 300 billion euros Greece owed them.

Greece Parliament Approves 85 Billion Euro Bailout Deal News Dw 14 08 2015

Greece Parliament Approves 85 Billion Euro Bailout Deal News Dw 14 08 2015

Athens imposed capital controls to stop capital flight.

Greece imf bailout history. The European Union the European Central Bank and the International Monetary Fund loaned debt-wracked Greece a total of 289 billion euros 330 billion in three successive programmes in 2010 2012 and 2015. If the objective underlying the bailout was. The Greek government misses its 16 billion euro 17 billion payment to the IMF when its bailout expires on June 30 making it the first developed country to effectively default to the Fund.

708bn to tackle its debt crisis. Five years later after the biggest bailout in the funds history Greece failed to make a 17 billion payment as required at the end of June the first advanced economy ever to default on the. Two days later the IMF warned that Greece needed 60 billion euros in new aid.

Greece has successfully completed a three-year eurozone emergency loan programme worth 619bn 55bn. 11 Both sides called it a delay not an official default. Greece has been represented on the IMF Board of Governors by Minister of Finance Christos Staikouras since 2019.

Greece elects an Executive Director on the funds Executive Board with Albania Italy Malta Portugal and San Marino. Greece is one of the original members of the International Monetary Fund joining it on December 27 1945. The Greek bailout programme which followed controversial IMF loan programmes after the Asian financial crisis in 199798 and economic turmoil in Argentina in 200203 was a high-profile example of the IMF not returning a country to solvency and better economic governance but being involved in a controversial programme of lowering living standards.

Greece suffered an economic hit comparable to the Great Depression in the US. Speech by Poul Thomsen Director of the European Department of the International Monetary Fund at the London School of Economics. Η Κρίση it reached the populace as a series of sudden reforms and austerity measures that led to impoverishment and loss of income and property as well as a small-scale humanitarian crisis.

On June 30 Greece became the first developed economy in the world to default on an IMF bailout. The second package came in 2012. It was part of the biggest bailout in global financial.

The first bailout came in 2010. I would like to thank the Hellenic Observatory and professor Featherstone for the invitation and you. The IMF and the Greek Crisis.

It is my pleasure to be here. Michail Psalidopoulos is the elected alternate director. The IMF the ECB and the European Commission announced a three-year aid package designed to rescue Greece.

Greece asked for a financial rescue by the European Union and International Monetary Fund. May 2 2010 - Prime Minister George Papandreou says he has sealed a deal with the EU and IMF opening the door for a bailout in return for extra budget cuts of 30 billion euros 43 billion over. Greeces creditors the European commission the European Central Bank and the IMF put the countrys total financing needs through end-2018 at 85bn which is 25bn more than what was projected.

Bailouts - emergency loans aimed at saving sinking economies - began in 2010. How the IMF Bungled the Greek Debt Crisis Greeces public debt which was 120 of the GDP when the IMF undertook the rescue has since risen to 170. The Greek government-debt crisis was the sovereign debt crisis faced by Greece in the aftermath of the financial crisis of 200708Widely known in the country as The Crisis Greek.

The Greek debt crisis. The Fund approved an exceptionally large loan to Greece under an stand-by agreement in May 2010 despite having considerable misgivings about Greeces debt sustainability. While euro zone and International Monetary Fund officials secretly debate how to deal with Greeces ever-controversial bailout it might prove instructive to go back to the genesis of the program.

The pain was made worse. On June 30 2015 Greece missed its scheduled 155 billion euros payment.

Greece Secures Third Bailout After Germany Backs Down On Opposition Eurozone Crisis The Guardian

Greece Secures Third Bailout After Germany Backs Down On Opposition Eurozone Crisis The Guardian

Public Sector Workers To Pay A Heavy Price For Greek Bailout Eurozone Crisis The Guardian

Public Sector Workers To Pay A Heavy Price For Greek Bailout Eurozone Crisis The Guardian

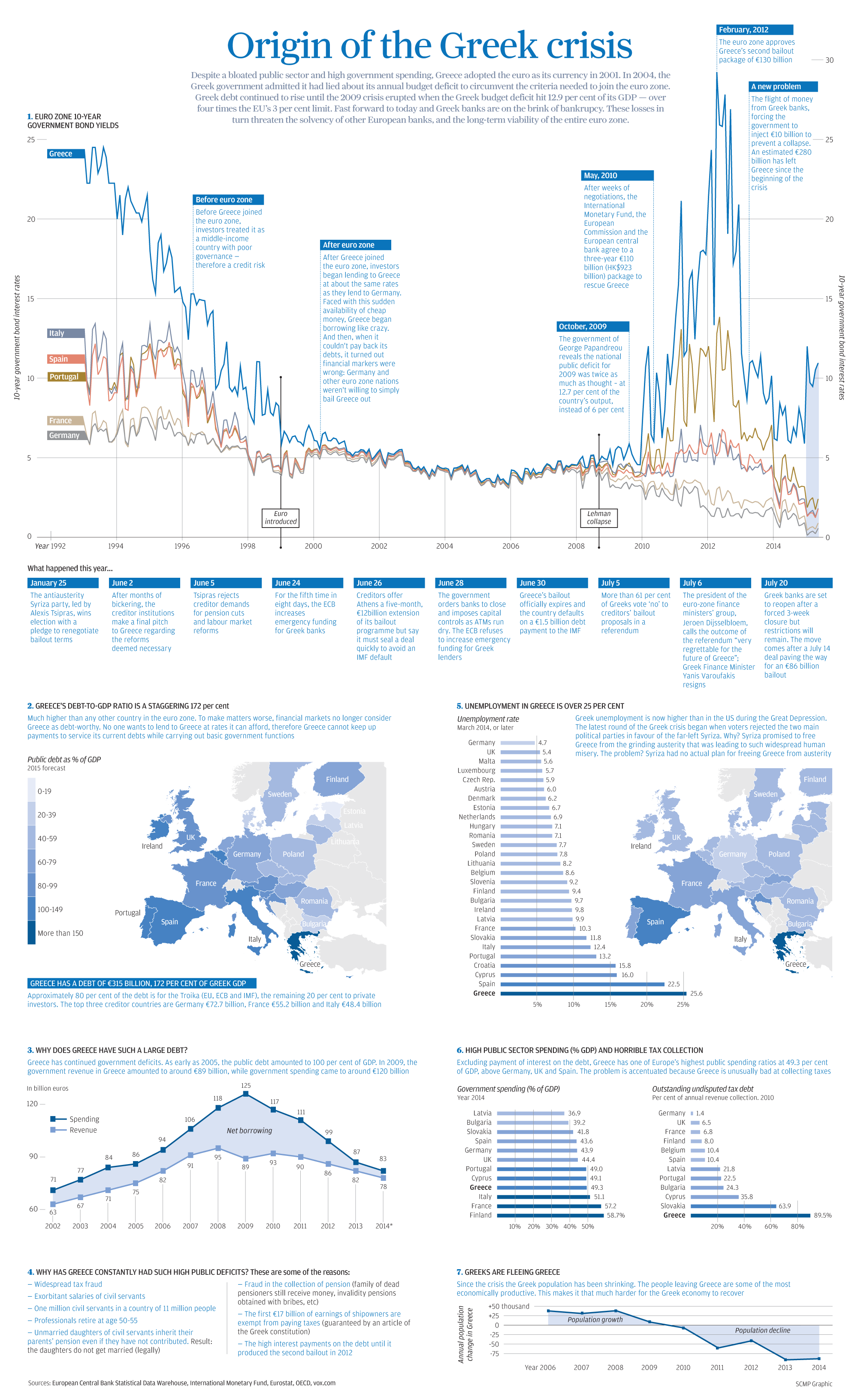

Infographic The Origin Of The Greek Crisis

Infographic The Origin Of The Greek Crisis

Imf Allows Greece To Bundle June Debt Payments Business Economy And Finance News From A German Perspective Dw 04 06 2015

Imf Allows Greece To Bundle June Debt Payments Business Economy And Finance News From A German Perspective Dw 04 06 2015

Greece S Debt Costs Rise Sharply As Worries Grow Over Imf Role Greece The Guardian

Greece S Debt Costs Rise Sharply As Worries Grow Over Imf Role Greece The Guardian

Athens Thorny Bailout Marriage With The Imf Business Ekathimerini Com

Athens Thorny Bailout Marriage With The Imf Business Ekathimerini Com

Euro Market Meltdown Resumes Despite Greek Deal Reuters

Imf Bailouts Roads To Stability Or Recipes For Disaster Business Economy And Finance News From A German Perspective Dw 04 09 2018

Imf Bailouts Roads To Stability Or Recipes For Disaster Business Economy And Finance News From A German Perspective Dw 04 09 2018

A Brief History Of Countries With Overdue Imf Repayments Business The Guardian

A Brief History Of Countries With Overdue Imf Repayments Business The Guardian

The Greek Crisis Imf Said To Seek Delay Of Greek Loan Repayments Until 2040

The Greek Crisis Imf Said To Seek Delay Of Greek Loan Repayments Until 2040

Greece Demands Imf Explanation Over Leaked Debt Transcript

Greece Demands Imf Explanation Over Leaked Debt Transcript

Why Statistical Accuracy Is One Topic At Greek Bailout Talks

Why Statistical Accuracy Is One Topic At Greek Bailout Talks

Greece Hopes For Better Times As It Exits Eu Bailout Program In Depth Dw 20 08 2018

Greece Hopes For Better Times As It Exits Eu Bailout Program In Depth Dw 20 08 2018

Greece Has Joined Somalia Sudan And Zimbabwe In Defaulting On The Imf Quartz

Greece Has Joined Somalia Sudan And Zimbabwe In Defaulting On The Imf Quartz

Pdf A Critical Evaluation Of Imf History And Policies

Pdf A Critical Evaluation Of Imf History And Policies

A Brief History Of Greek Defaults Visual Ly

A Brief History Of Greek Defaults Visual Ly

Greece Bailout Deadline Approaches

Greece Bailout Deadline Approaches

Greece Defaults On 1 7 Billion Imf Payment World News

Greece Defaults On 1 7 Billion Imf Payment World News