Imf Bank Dividends

bank dividends wallpaperAnother cycle of non-payment of salaries to begin soon. A sharp recession followed by expectations of a V-shaped recovery as predicted by the IMF is unique in the context.

Https Www Imf Org Media Files Publications Fiscal Monitor 2020 April English Onlineannexes31to37 Ashx La En

IMF staff calculate that the 30 global systemically important banks distributed about 250bn in dividends and share buybacks last year.

Imf bank dividends. This year they should retain earnings to build capital in the system. World Bank IMF and Dev Agencies. Lending and Records Center Bank-Fund Staff Federal Credit Union 1725 I Street NW Suite 400 Washington DC 20006-2406.

According to the IMFs calculations 30 lenders that it considers to be global systematically important banks spent the equivalent of around 250 billion on dividend payouts and stock buybacks. Bank of Americas Healthy Dividend. Policy support is key to financial stability with IMFs Fabio Natalucci SDR Rates for February 11 2021 SDR Interest Rate 0090 1 USD SDR 069329 MORE The IMF and COVID-19.

One of the steps needed to reinforce bank buffers is retaining earnings from ongoing operations. How e-Government Services Can Pay Dividends. These are not insignificant.

The International Monetary Fund IMF has backed the halting of dividend payments and share buy backs by banks in response to the Covid-19 pandemic. According to the multilateral lender the suspension of dividend payments by banks this year will help preserve much needed funding to ride the prevailing storm. IFC Branch Other Branch Locations2100 K Street NW Washington DC 20433.

IMF staff calculate that the 30 global systemically important banks distributed about US250bn in dividends and share buybacks last year. IMF staff calculate that the 30 global systemically important banks distributed about 250bn in dividends and share buybacks last year. All stakeholders will ultimately benefit.

The IMF chief admitted that suspension of dividend payments would have unpleasant implications for shareholders including retail and small institutional investors for whom bank dividends may be. Invest in FGN Monthly Bond Auction - February 2021. These are not insignificant.

Ameris Bank was founded in 1971 in Moultrie GA which is just over 150 miles from Jacksonville. One of the steps needed to reinforce bank buffers is retaining earnings from ongoing operations she wrote in an editorial posted on the IMFs website. The International Monetary Fund IMF has backed the halting of dividend payments and share buy backs by banks in response to the Covid-19 pandemic.

IMF staff calculate that the 30 global systemically important banks distributed about 250bn in dividends and share buybacks last year. This year they should retain earnings to build capital in. Its one of the regional banks in Jacksonville FL that serves four southeastern states.

1593 of OMOMORBNKs Outstanding Shares Traded on NSE Today. According to the multilateral lender the. This year they should retain earnings to build capital in the system.

International Monetary Fund IMF Managing Director Kristalina Georgieva advised banks to halt dividends and buybacks as reported by the Financial Times. Thats reflected in bank share prices which are down 323 per cent this year. Bank regulators should also act faster to roll back temporary relief measures that undermine the reliability of financial.

If you were a customer of The Jacksonville Bank youll be familiar with them because Ameris acquired them a few years ago. One of the steps needed to reinforce bank buffers is retaining earnings from ongoing operations. BERLIN Nov 18 Reuters - The International Monetary Fund IMF has urged German bank supervisors to tell private lenders like Deutsche Bank and Commerzbank to refrain from paying dividends and.

IMF chief urges halting of bank dividends buybacks In an opinion piece published on the Financial Times on Thursday the IMF chief said even though the resilience of the financial system has been significantly strengthened after the 2008 financial crisis. IMF urges bank regulators to extend curbs on dividends buybacks. Regulators should extend limits on banks capital distributions to help protect the financial system in case the global economic recovery proves slow the International Monetary Fund IMF said a recommendation that comes just as some large lenders are itching to resume repurchasing stock and paying dividends.

New York Regulators should extend limits on banks capital distributions to help protect the financial system in case the global economic recovery proves slow the International Monetary Fund.

1 Coordinating Public Debt And Monetary Management In Transition Economies Issues And Lessons From Experience Coordinating Public Debt And Monetary Management

1 Coordinating Public Debt And Monetary Management In Transition Economies Issues And Lessons From Experience Coordinating Public Debt And Monetary Management

Arab Republic Of Egypt Arab Republic Of Egypt Selected Issues

Arab Republic Of Egypt Arab Republic Of Egypt Selected Issues

Imf Says Banks Will Struggle To Be Profitable Through 2025

Imf Says Banks Will Struggle To Be Profitable Through 2025

5 The Imf S Income Model Imf Financial Operations 2018

5 The Imf S Income Model Imf Financial Operations 2018

About The Imf Organization And Finances Income Model Reform

About The Imf Organization And Finances Income Model Reform

Does Brics Banking Offer An Alternative To The Imf And World Bank Pessimistic Signals From South Africa

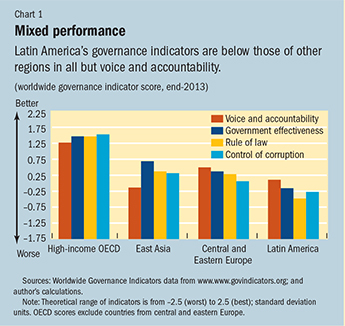

Corruption Matters Finance Development September 2015

Corruption Matters Finance Development September 2015

Current Account Deficits Is There A Problem Back To Basics Finance Development

Current Account Deficits Is There A Problem Back To Basics Finance Development

Growth S Secret Weapon The Poor And The Middle Class Imf Blog

Growth S Secret Weapon The Poor And The Middle Class Imf Blog

Imf And Wb The Destruction Of Indonesia S Sovereignty

Pdf The Demographic Dividend Evidence From The Indian States

Pdf The Demographic Dividend Evidence From The Indian States

Transparency In Central Bank Financial Statement Disclosures Transparency In Central Bank Financial Statement Disclosures

Transparency In Central Bank Financial Statement Disclosures Transparency In Central Bank Financial Statement Disclosures

Bank Dividend Regulation Impact Of The Covid 19 Pandemic Global Risk Institute Global Risk Institute

Bank Dividend Regulation Impact Of The Covid 19 Pandemic Global Risk Institute Global Risk Institute

Imf German Banks Shouldn T Pay Dividends Do Share Buy Backs During Pandemic Reuters

Imf German Banks Shouldn T Pay Dividends Do Share Buy Backs During Pandemic Reuters

Chapter 3 Changes In Bank Funding Patterns And Financial Stability Risks Global Financial Stablity Report October 2013 Transition Challenges To Stability

Chapter 3 Changes In Bank Funding Patterns And Financial Stability Risks Global Financial Stablity Report October 2013 Transition Challenges To Stability