Dd214 For Va Home Loan

dd214 home loan wallpaperYour eligibility for VA benefits relies on the type of discharge you had. The DD214 form shows the type of discharge you had from the military.

Kentucky Va Lending Guide Same Day Loans Va Mortgages Va Mortgage Loans

Kentucky Va Lending Guide Same Day Loans Va Mortgages Va Mortgage Loans

For most veterans this will be a copy of your DD214.

Dd214 for va home loan. For-a-fee DD214 sites claim to be run by veterans for veterans and promise to get DD214s back to the applicant in a hurry which would seem to justify their fee. Providing a Certificate of Eligibility COE is one of the first steps youll take to begin the home loan application process but to do so you will need to produce a copy of your DD214. Our researchers are experts in acquiring the documents that are required by the VA for their home loan program.

For Army or Air Force National Guard you will need your NGB Form 22 Report of Separation and Record of Service or NGB Form 23 Retirement Points Accounting or its equivalent this is similar to a retirement points summary. Anything less than honorable may make you ineligible for the VA loan. But in cases where a veteran dies after retiring or separating from the military the surviving spouse may apply for a VA loan.

Click here to check todays low VA loan rates and see if you are eligible. Lenders can use the DD-214 to obtain your Certificate of Eligibility which formally documents your eligibility for the home loan benefit. In cases like these there are forms to fill out and documents to submit including a copy of the deceased veterans DD Form 214.

Known as the Certificate of Release or Discharge From Active Duty the DD-214 usually contains everything the VA needs in order to determine whether youre eligible for the home loan benefit. This form is basically your proof that you joined and served in the Armed Forces of the United States. This is not the case with the majority of conventional loans.

The DD Form 214 also known as the Certificate of Release or Discharge from Active Duty is the separation document issued by the US Department of Defense. The First Step toward Getting a VA Home Loan. Before you apply make sure you have a copy of your DD214.

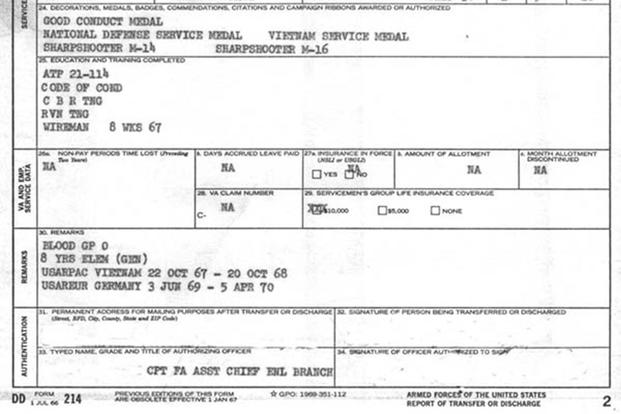

A site run by actual veterans would tell you up front that theres no need for you to PAY for a replacement copy of your DD Form 214. This document contains information regarding a service members military separation retirement or discharge. For veterans obtaining a COE means you must first have a copy of your DD214 showing specifically the character of service and the narrative reason for separationitems 24 and 28 on the form.

Once you have a copy of your COE you can apply for your VA home loan online through your lender or by mail. The first step toward getting approved for a VA home loan is completing your certificate of. A DD 214 is an essential document to get a certificate of eligibility which is your key to enjoying the VA home loan benefit.

If you search for it and realize you never received your DD214 or that it is missing or damaged you will need to order a new copy before completing your home loan application. If you are separated from the Military your VA Approved Lender will need a copy of your DD214 in order to establish your VA Eligibility and benefits. If youre receiving Dependency Indemnity Compensation DIC youll need to fill out and send us a Request for Determination of Loan Guaranty EligibilityUnmarried Surviving Spouses VA Form 26-1817.

If you fit the criteria the next step is getting a valid certificate of eligibility or COE which lets your lender know you qualify for the VA home loan benefit. Use your DD214 to show proof of service. Dont believe the hype.

For veterans obtaining a COE means you must first have a copy of your DD214 showing both the character of service and the narrative reason for separationitems 24 and 28 on the form. Fastest DD214 Delivery 2pm to 1am UTC weekdays search. Youll need this form and information when you want to use your VA benefits including the VA home loan.

When it comes to VA home loans for example a surviving spouse may be eligible to use the service members VA loan eligibility under the right circumstances. If you do not have a copy of your DD214 you can fill out the Pre-Qualification Form and a VA Specialist with a VA Approved Lender will be able to pre-qualify you as well as assist you in obtaining your DD214 along with the other required documents for a VA Mortgage. If youre a surviving spouse who qualifies for home loan benefits youll need the Veterans discharge documents DD214if availableand.

Once you have a copy of your COE you can apply for your VA home loan online through your lender or by mail. VA loans are also assumable meaning another buyer can take over your mortgage loan and keep the existing interest rate and terms. The VA Certificate of Eligibility Why you may need your DD214.

Naturally if a military member dies on active duty there is no DD214 to submit. If youre thinking of buying a home with a VA home loan but have never purchased one before you might be surprised at how early in the process youre required to use your DD214 to qualify for VA mortgage benefits. Click Order my DD214 to get started.

Department of Veterans Affairs VA Home Loans and Housing-Related Assistance program got its start in 1944 as the Servicemens Readjustment Act commonly known as the GI. But first you will need a copy of your DD214. You could be eligible for a VA loan.

Download VA Form 26-1817 Request for Determination of Loan Guaranty Eligibility - Unmarried Surviving Spouses. If you need a replacement DD Form 214 returned to you before VA loan processing deadlines there are several steps you should take and important facts to keep in mind when placing your request for a replacement DD214 through the National Personnel Records Center in St. Delivery to the NPRC.

Spouses can take the VA form 26-1817 to their lender for processing see Apply Through Lender above or may mail the 26-1817 and DD214 if available to the following address. Find out whats in a DD Form 214 and how you can obtain a copy of it. Military members are entitled to apply for VA home loans as part of their military benefits but unlike some military benefits like healthcare Service members Group Life Insurance SGLI or GI Bill education benefits VA mortgages are not guaranteed-you must apply for them have your credit reviewed and accept the terms offered by your lender and the Department of Veterans Affairs.